Let’s work together

Want to discuss potential opportunities? Pick the most suitable way to contact us.

Book a call+370 5 2 780 400

info@ba.lt

If mobile banking was rather a nice-to-have a few years ago, now it is a definite must-have. In this case, the rapid digitalisation of financial institutions and evolving consumer needs push for more mobile banking services.

From the financial institutions’ perspective, the Economist‘s report shows 47% of banks see their business evolving into actual digital ecosystems, which offer own or third-party banking products, including mobile banking applications.

This is why we are excited to share a case study showcasing the mobile banking solution we developed for the Lithuanian Central Credit Union (LCCU).

LCCU is the largest credit union that comprises 44 unions throughout Lithuania, forming the LCU Credit Union Group that serves over 121 thousand customers across different country regions. A significant part of credit union clients still carries out day-to-day transactions at their credit union’s customer service desk. In contrast, around half of customers use e-banking services.

Given such different customer habits, the LCU Credit Union Group has not yet had its smart app to meet the needs of customers using mobile banking services. Also, developing a mobile banking app may take up to 1 year. Consequently, LCCU has decided to initiate a mobile app project to address these requirements.

Leveraging the financial industry know-how, specifically mobile banking development projects, Baltic Amadeus has proposed implementing a mobile banking app development project to move LCU Credit Union Group services’ accessibility and quality to a new level.

The developed mobile banking solution adheres to global NextGenPSD2 and Berlin Group standards. The mobile app links to the central LCU system through an open API, ensuring it meets necessary technical and organizational standards. The LCU mobile application development process guarantees all required security and compliance elements. Our experts, who crafted the LCU mobile app, hold certifications in CISSP and CDPSE for added assurance.

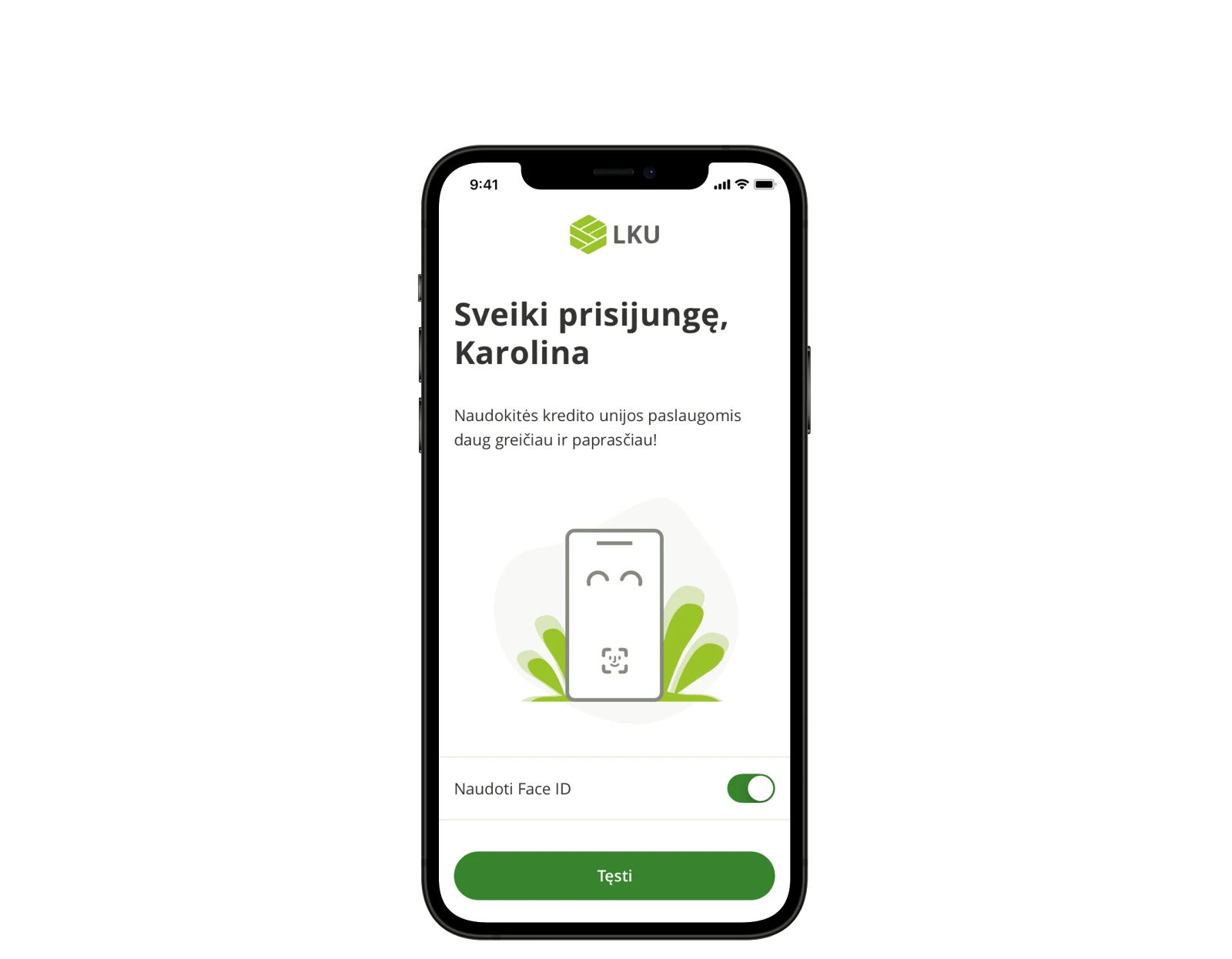

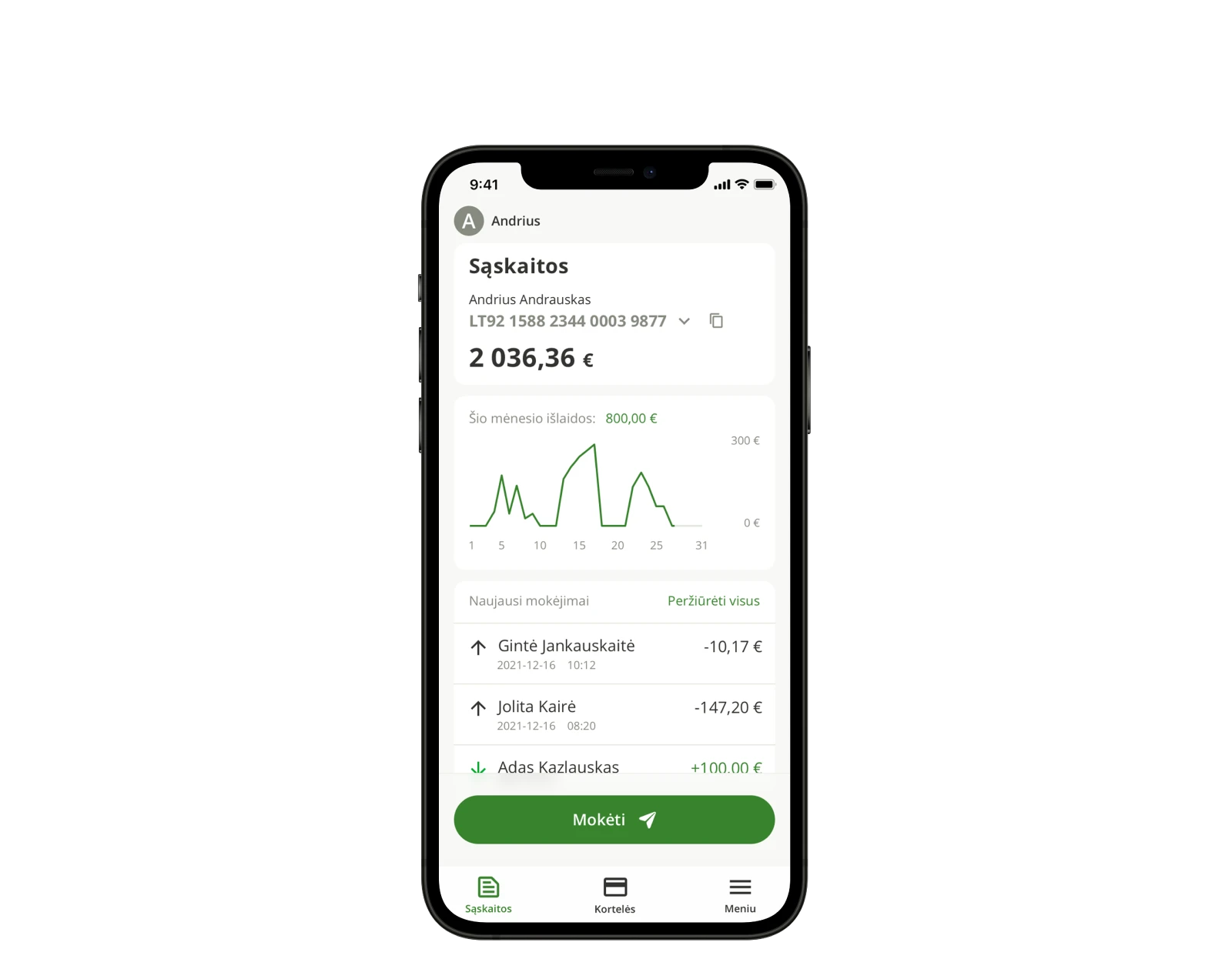

Our team developed a PSD2-based mobile banking app with a unique LCU brand design. The newly developed mobile banking solution allowed the mobile app’s functionality to be updated and enhanced to meet the customer’s specific needs. The new mobile banking solution has also enabled the customers of the LCU group of credit unions to use the mobile application on both Android and iOS operating systems.

LCU mobile banking application is a cloud-based solution that runs on the AWS public cloud. This ensures LCCU gets their highly secured and scalable isolated infrastructure consisting of AWS EC2, EKS, ELB, KMS, SNS, S3, DynamoDB, and CloudWatch cloud services.

The newly developed mobile application operates on a cloud-based system, giving the client control over app infrastructure and cost optimisation. This infrastructure minimises expenditures while maintaining optimal service performance for LCCU.

The LCU smart app allows access to payment accounts for both private and corporate customers. Private users of the app can make payment transfers, view the account balance, check the list of payments made and carry out other daily operations with just a few clicks.

Also, private customers using the app can call and send a message to their credit union specialist. The current functions of the app are planned to be extended to business customers in the near future.

Want to discuss potential opportunities? Pick the most suitable way to contact us.

Book a call+370 5 2 780 400

info@ba.lt

FL Technics

ArcaPay

Darnu Group

Vesta Consulting

JTI Lithuania

OPAY

Omnicus

JTI Lithuania

Vesta Consulting

JTI Lithuania

JTI Lithuania

Optiwork

Clever Transco LLC

ProMark

TT-Line

Internews

Lytagra

Börsdata

General Financing Bankas

ConnectPay

Lietuvos Draudimas

Bitė

Bitė

Professional Billing, Inc.

WilNor Governmental Services AS

EUROAPOTHECA

DNB BANK

Hostinger

KREDA

DNB bank

Shippersys

Shippersys

Akershus County

Star Information Systems

UAB Technologijų ir inovacijų centras

FamWeek

SIMCOM AS

Norwegian Aviation Museum

UNIPARK

TELIA